I make good money.

After 15 years in business, multiple revenue streams, and no personal debt, I’ve got some dry powder sitting.

But I’m not parking it in NFTs, SPACs, or chasing whatever influencer told you was the “next big thing.”

I’m focused on protection, yield, and leverage through tax strategies.

That’s where municipal bonds funds, municipal bonds ETFs, and tax-exempt municipal bonds come into play. And i can invest as much money i like, without The IRS telling me how old I have to be to participate or how much i can invest in it.. This strategy is straight forward not confusing, and I bet you no one ever talks about it enough. I can guarantee you if you dont understand it fully, you will not get full advantage of my work here. So lets dive in

What Are Municipal Bonds?

Think of municipal bonds like this:

Your city, county, or state wants to build something: schools, bridges, parks, hospitals.

To raise money, they issue bonds—basically I.O.U.s—and you, the investor, lend them money in exchange for regular interest payments.

Now here’s the kicker: those interest payments are usually tax-free.

And I’m not just talking about federal tax. If you live in a place like California or NYC and buy bonds from your state, they can be triple-tax free (federal, state, and local).

That’s like a 7–8% taxable return for someone in a high bracket, without the stock market’s ups and downs.

Time Limits, Lock-in Periods, and Real Expectations

Let’s clear something up: municipal bonds aren’t get-rich-quick.

They usually have maturity periods ranging from 3 to 30 years.

That doesn’t mean your money is locked forever. You can often sell bonds on the secondary market, especially if they’re part of a municipal bond ETF or mutual fund. But it’s wise to think long-term.

Now here’s where the tax bracket comes in:

If you’re earning over $191,950 (single) or $383,900 (married filing jointly) in 2025, you’re in the 32% federal tax bracket or higher. That means:

- A 3% municipal bond yield = over 4.4%+ taxable equivalent yield

- A 4% municipal bond yield = 6.2%+ taxable equivalent yield

And if you’re in California or New York City paying high state income tax? The benefits get even sweeter.

This is why I always say:

“If you’re already in the kitchen cooking, you might as well use the right ingredients.”

Municipal bonds are one of those ingredients if you’re in a high-income bracket and want to protect your wealth.

Are Municipal Bonds Safe?

Here’s the honest answer:

Most are, but not all.

Look for AAA-rated municipal bonds. These are backed by strong cities or essential public services that have never defaulted in modern history.

Some well-known AAA-rated municipal bonds (as of now) include:

- Georgia GO Bonds (General Obligation bonds)

- Texas Water Development Board Bonds

- University of North Carolina System Bonds

- California State GO Bonds (some of them)

- New York State Environmental Facilities Corp

You can access these via your broker (Fidelity, Schwab, Vanguard), or through municipal bond ETFs like:

- Vanguard Tax-Exempt Bond ETF (VTEB)

- iShares National Muni Bond ETF (MUB)

- SPDR Nuveen Bloomberg Municipal Bond ETF (TFI)

These are diversified, lower-cost, and trade like stocks. You don’t need to be a bond expert to get in the game.

Where Do You Buy Municipal Bonds?

You’ve got options:

1. Brokerage Account

Just like you’d buy Apple stock, you can buy municipal bonds ETFs or individual bonds through Fidelity, Schwab, or Vanguard. Most offer screeners where you can filter by:

- State (for tax-free stacking)

- Maturity date

- Rating (AAA, AA, etc.)

- Yield

2. Municipal Bond Funds

Actively managed funds like those from Nuveen or BlackRock may cost a bit more in fees, but can get you exposure to harder-to-access high-yield munis.

3. Direct from Your State Treasury

This is the old-school route. Some bonds are sold directly through the state’s website or official bond offering portals. Not always easy, but worth checking if you’re looking local.

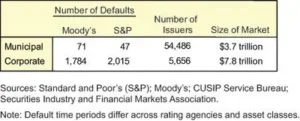

What About Defaults?

This is the part no one talks about.

Yes, some municipal bonds have defaulted—like Detroit or Puerto Rico.

But most of those were lower-rated, high-yield “junk” munis. If you stick to essential service bonds—like water, sewer, electricity, schools—you’re in a safer zone.

Still, don’t just chase municipal bonds high yield.

Check the credit rating, the issuer, and the state’s financial health. A 5% yield from a risky city is not the same as a 3.5% yield from a rock-solid state government.

What Kind of Income Can You Expect?

Let’s say you park $250,000 in a mix of AAA municipal bonds and municipal bonds ETFs.

At a conservative 3.5% tax-free yield, that’s $8,750 per year you’re getting with zero federal taxes.

If you’re in California or New York and choose local bonds, that $8,750 is triple tax-free.

Compare that to parking that same $250,000 in a savings account making 1.5% taxable interest—you’d walk away with less than $3,000 after taxes.

Final Word: Tax-Free Cash Flow is Underrated

If you’re a high-income earner or small business owner grinding it out every month, take this seriously:

Cash flow that’s tax-free hits different.

It feels like you’re finally playing on the same field the ultra-wealthy play on.

If you’ve ever asked,

“Why do I feel broke while making $300K/year?”

This is part of your answer: taxes are eating you alive.

Municipal bonds won’t 10x your net worth overnight—but they will help you keep more of what you earn, and that’s what the game’s about.

What’s Next?

I’ll be talking more about:

- How to build a muni bond ladder that creates monthly tax-free income

- Differences between municipal bonds funds and individual bonds

- How to spot municipal bonds high yield scams and avoid traps

- Building a multi-asset strategy that includes oil & gas, real estate, and munis

- The real impact of municipal bonds yield vs. inflation

Listen to the Full Podcast on Spotify

Want the full story with real examples and personal commentary?

Search “Main Street Hustlers” on Spotify or Apple Podcasts.

Or hit the link in the description to listen now.

Link in the description

Need help figuring out where to start?

Drop a comment below or DM me on Instagram. I read every message.

Let’s build real wealth—one smart move at a time.