Trump’s Intel Deal – Why It’s a Big Deal for the U.S.

So here’s what’s cooking.

The Trump administration is talking about something that doesn’t happen often in America — the U.S. government actually buying a stake in a private company, in this case Intel.

The whole point? Speed up building Intel’s massive chip factory campus in Ohio — a project that’s been hyped as the future of American semiconductor manufacturing.

Right now, Intel’s Ohio project is moving at a snail’s pace. The original plan was to have chips rolling out by the mid-2020s. Now? We’re looking at 2030–2031 before the first batches are made. That’s way too late if America wants to reduce its dependence on Asia for the tech that powers everything from smartphones to fighter jets.

Why the U.S. Is So Interested

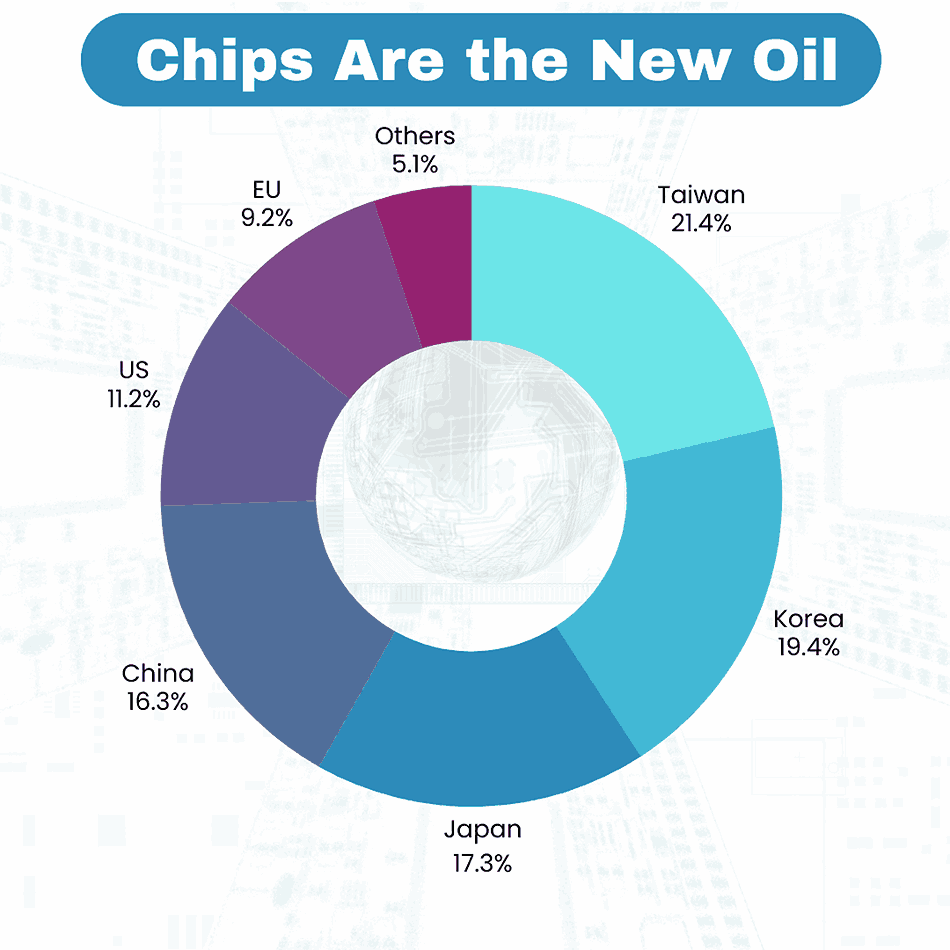

1. National Security – Right now, America depends heavily on Taiwan for advanced chips. If tensions with China boil over, that supply chain could get wrecked overnight. Making chips at home means less risk.

2. Economic Powerhouse – This isn’t just about tech. Chips are the “oil” of the 21st century. Whoever controls chip production controls a huge chunk of the future economy.

3. Job Creation – The Ohio site could bring thousands of high-paying jobs and billions in local economic activity. These aren’t just factory jobs — we’re talking engineers, technicians, suppliers, and support industries.

4. Global Competition – China’s been pouring money into its own chip industry. The U.S. can’t sit around hoping the free market keeps up — especially when the competition is playing with government money.

The Numbers You Should Know

Total Project Cost: Around \$100 billion over time.

First Phase: Worth tens of billions just to get started.

Timeline: Delayed from 2025–2026 targets to 2030–2031.

Stock Reaction: Intel shares jumped 7% in normal trading and another 4% after hours when the news broke.

Investor Sentiment: A Stocktwits poll showed 71% think this deal will actually happen.

Why This Is Different

Normally, the U.S. government helps companies like Intel with tax breaks and subsidies. This time, they’re talking about owning part of the company — meaning taxpayers would technically have a piece of Intel. That’s a big shift in strategy.

It’s more like what China and some European countries do — direct investment to guarantee the outcome. In business terms, it’s the government saying:

> “We’re not just cheering from the sidelines, we’re putting money on the table — because losing this race is not an option.

Bottom line:

If this deal goes through, America gets more control over its chip supply, less dependence on China and Taiwan, a stronger economy, and thousands of jobs. But it also marks a shift toward the government playing a much more hands-on role in private business — and that’s going to spark a lot of debate.